Caring for a child on the autism spectrum involves ongoing expenses. In India, these costs can add up over time, especially in private and urban settings.

For many families, monthly expenses range from ₹10,000 to over ₹30,000, depending on the intensity of support needed. This usually does not include medication or specialised education.

Therapies form the core of autism care. ABA therapy typically costs between ₹800 and ₹2,000 per session. Speech therapy ranges from ₹700 to ₹1,500 per session, while occupational therapy may cost ₹800 to ₹1,800 per session.

Some families opt for structured or full-day therapy programs. These programs, often run by private centres, can cost anywhere between ₹30,000 and ₹80,000 per month. Initial diagnosis and assessments are another expense. Most evaluations fall in the ₹1,500 to ₹4,000 range.

Special education support is another important cost. Monthly fees for specialised schooling or learning support usually range from ₹5,000 to ₹15,000. These services are often essential to a child’s development but are rarely fully covered by standard policies.

There are also alternative interventions that families may come across. For example, stem cell therapy is sometimes promoted, though it is not widely recommended. These treatments can be very expensive, often costing ₹3.3 lakh to ₹8 lakh per cycle.

Common Myths Around Autism Insurance in India

Many parents feel confused or discouraged when exploring autism insurance in India. This is often due to myths that circulate online or through word of mouth. Below are some common misunderstandings, explained simply and clearly, so families can make informed decisions.

Common Myths vs Facts

| Myth | Reality |

| No insurance covers autism in India | Autism insurance coverage does exist, mainly through government schemes and a few specialised private policies. Coverage is limited, but it is not absent. |

| Private health insurance completely excludes autism | While standard plans may restrict coverage, some private insurers offer autism-specific or disability-focused policies with defined benefits. |

| All autism therapies are fully covered. | Most policies place limits. Hospitalisation is more commonly covered, while therapies are subject to caps, conditions, or exclusions. |

| Insurance is only useful for young children. | Autism is a lifelong condition. Some government-backed options and disability-linked benefits continue into adulthood. |

| Autism, being a pre-existing condition, means no coverage at all | Some specialised autism insurance plans do not require pre-policy medical screening and still offer defined benefits. |

What Parents Should Keep in Mind

- Specialised policies are limited but real: Autism insurance is not widely available under general plans, but specific options do exist. These are designed with clear limits and eligibility criteria.

- Government support plays a key role: Public schemes remain an important part of insurance coverage for autism in India, especially for therapy and OPD support.

- Not all treatments are treated equally: Core medical care and diagnostics are more likely to be included than experimental or alternative therapies.

- Coverage terms matter more than policy names: The best health insurance for autism depends on what is covered, how much is covered, and how claims work in practice.

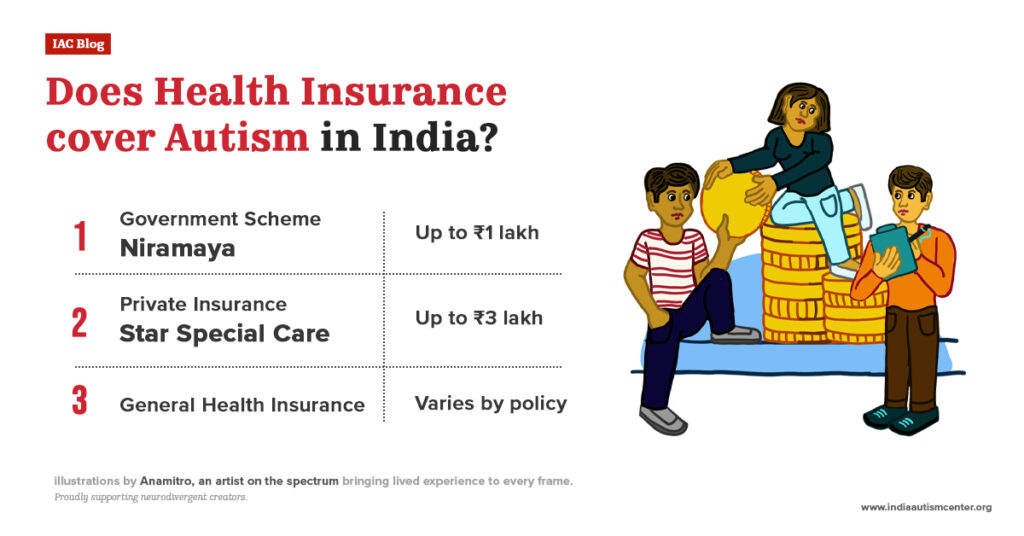

Does Health Insurance cover Autism in India?

Yes, autism is covered by health insurance in India. However, the coverage is limited and works differently from regular health insurance. Most support comes through government-backed schemes and a few specialised private policies.

Autism is usually treated as a lifelong or pre-existing condition. Because of this, coverage is not automatic under standard plans. This is why families often need autism insurance India–specific options rather than regular policies.

Main Health Insurance Options for Autism in India

| Type of Plan | Who It Is For | Coverage Details | Typical Limit |

| Government Scheme (Niramaya) | Persons with autism and other developmental disabilities | OPD care, therapies, diagnostics, and hospitalisation | Up to ₹1 lakh |

| Private Insurance (Star Special Care) | Children and young adults aged 3–25 years | Hospitalisation, OPD, therapies, diagnostics | Up to ₹3 lakh |

| General Health Insurance | All individuals | Mostly hospitalisation for related conditions | Varies by policy |

Autism Health Insurance in India: What Coverage Really Looks Like

Government Scheme: Niramaya Health Insurance

The Niramaya Health Insurance Scheme is one of the most accessible autism insurance options. The National Trust runs it for people with autism and related disabilities.

Key features include:

- Coverage up to ₹1 lakh per year

- Includes OPD expenses

- Covers therapy sessions and hospitalisation

- Designed specifically for developmental disabilities

Private Autism Insurance Options

Some private insurers offer specialised plans. A well-known example is Star Special Care.

What these plans usually cover:

- Children and young adults with autism

- Hospitalisation for medical conditions

- OPD consultations and diagnostics

- Limited therapy coverage, based on policy terms

The maximum sum insured is usually up to ₹3 lakh. These plans are often considered when families seek the best health insurance for autism, though coverage limits should be carefully reviewed.

General Health Insurance and Autism

Regular health insurance policies may cover autism-related care to a limited extent.

Important points to know:

- Autism is often classified as a pre-existing condition

- Waiting periods may apply

- Coverage usually focuses on hospitalisation

- Therapy and OPD benefits are often restricted

Under IRDAI guidelines, insurers must have clear underwriting rules for persons with disabilities. This improves transparency but does not guarantee full autism insurance coverage.

What Is Commonly Covered

Across government and private options, coverage usually includes:

- Hospitalisation for associated medical conditions

- Therapies, such as speech or behavioural therapy, are subject to limits

- Medicines and diagnostics, often under OPD benefits

Disability Insurance and Autism: What Parents Need to Know

In India, autism is legally recognised as a disability under the Rights of Persons with Disabilities (RPWD) Act, 2016. This recognition is important. It allows families to access government support, financial assistance, and disability-related benefits. While disability insurance works differently from health insurance, both play a role in long-term planning for autism.

Why a Disability Certificate Matters

A disability certificate is the foundation for accessing most benefits related to autism.

What it enables:

- Eligibility for government schemes and pensions

- Access to education and welfare benefits

- Support for financial planning and future care

Without this certificate, many forms of assistance linked to disability insurance and government aid are not available.

Steps Parents Should Take

- Obtain a disability certificate: Apply through authorised government hospitals or local authorities. This certificate officially confirms autism as a recognised disability under the law.

- Keep clear records: Maintain copies of diagnosis reports, therapy plans, and expense records. These documents are often required for claims, renewals, and government benefits.

- Consult professionals: Speak with specialists or financial advisors who are familiar with autism insurance options in India. They can help identify suitable health and disability insurance plans that align with your child’s needs.

- Prepare a Letter of Intent (LOI): An LOI is not a legal document, but it is very important. It explains your child’s daily routine, therapies, preferences, and long-term care needs. This helps future caregivers or guardians understand how to support your child.

Financial Assistance Available in India

| Support Type | What It Offers | Who It Helps |

| Indira Gandhi National Disability Pension Scheme | Monthly pension support | Low-income families |

| Tax benefits under the Income Tax Act | Deductions on medical treatment and insurance premiums | Parents of children with disabilities |

Disability Insurance vs Health Insurance

- Health insurance usually focuses on medical care, hospitalisation, and limited therapies.

- Disability insurance and disability-related schemes focus on income support, long-term care, and social security.

Long-Term Financial Planning for Autism Beyond Insurance

Insurance is only one part of the picture. Autism care often continues for life, and many needs fall outside what autism health insurance or disability insurance can cover. Long-term financial planning helps families build stability, maintain continuity of care, and achieve peace of mind.

Build a Dedicated Care Corpus

Create a separate investment pool meant only for your child’s lifelong needs. This corpus should not be mixed with regular household savings.

- Use equity mutual funds for long-term growth

- Add debt instruments for stability and predictable access

- Plan with medical inflation in mind, which can be much higher than general inflation

Set Up a Private Trust

A private, non-revocable trust helps protect assets meant for the child.

Key points to consider:

- Create a formal trust deed

- Appoint trustees younger than the parents, such as siblings or close relatives, rather than the parents.

- Clearly define how funds should be used for care and support

Some families also explore options under the National Trust Act of 1999, which supports guardianship planning for persons with disabilities.

Use Government Schemes and Tax Benefits

Government benefits can reduce long-term financial pressure when used correctly.

| Benefit | What It Helps With |

| UDID card | Access to disability-related services and schemes |

| Section 80DD tax deduction | Up to ₹1.25 lakh for severe disability |

| Disability-linked schemes | Income and welfare support |

Maintain a Larger Emergency Fund

Families caring for a child with autism often face sudden cost spikes.

- Keep an emergency fund at least 50% larger than a typical household’s

- Maintain it separately from regular savings

- Use it only for urgent medical or care-related needs

Invest Systematically for the Long Term

Systematic Investment Plans help spread risk and build discipline.

- Equity-oriented SIPs support long-term growth

- Long time horizons help manage care-related inflation

- Regular investing reduces dependence on short-term funding

Plan Guardianship and Write a Will

A legal will is essential for long-term security.

- Appoint a trusted guardian

- Clearly state how funds should be managed

- Align the will with trust structures, if any

Key Financial Instruments to Consider

| Instrument | Why It Helps |

| Public Provident Fund (PPF) | Low risk and tax-free returns |

| Sukanya Samriddhi Yojana | Long-term savings for a girl child |

| Mutual funds | Higher return potential over long periods |

Practical Steps Parents Can Take

- Review investments once a year

- Allocate 20-30% of income toward therapies, education, and caregiving.

- Connect with support organisations such as Action for Autism for guidance and resources.

How India Autism Centre Supports Families Beyond Care

For individuals with autism and related conditions, daily life can feel demanding. For families, the emotional and practical challenges often continue for years. Support needs go beyond therapy sessions or medical care.

This is where the India Autism Centre steps in.

Located in Sirakol, about an hour from Kolkata, the Centre is building a calm and inclusive environment. The focus is not only on care, but on long-term support, dignity, and independence.

India Autism Centre is a not-for-profit initiative. Its mission is to create a complete ecosystem for individuals with autism and related conditions. This includes residential living, skill development, and research-led programs that respond to real needs.

Residential Support

The Centre provides structured residential care designed around safety, routine, and personal growth. This helps families plan for continuity of care while knowing their loved ones are supported in a stable environment.

Skill-Building and Vocational Training

India Autism Centre focuses on helping individuals build practical skills. These programs support independence, confidence, and participation in daily life, based on each person’s abilities and pace.

Training for Professionals

The Centre also runs training courses for aspiring caregivers and professionals. This helps strengthen the overall autism support ecosystem in India by improving the quality of care and understanding.

Research-Driven Approach

Research is a key part of the Centre’s work. By studying autism and related conditions in the Indian context, India Autism Centre contributes to better practices, informed interventions, and long-term solutions.

Frequently Asked Questions

Does health insurance cover autism in India?

Yes, but coverage is limited. It is mainly available through government schemes and a few specialised private policies.

Which is the best health insurance for autism in India?

There is no single best plan. Government schemes and autism-specific policies work best when combined based on the child’s needs.

Does disability insurance help families with autism?

Yes. Disability-related benefits provide financial support, pensions, and tax relief that health insurance may not cover.

Does insurance fully cover therapy costs?

No. Most policies have limits. Therapies are often partially covered or capped.

Is long-term financial planning necessary even with insurance?

Yes. Insurance alone is not enough. Long-term planning helps manage lifelong care, emergencies, and future security.

For expert insights, support services, and inclusive learning initiatives, visit the India Autism Center.